This has been slightly edited from the original.

Dear Friends,

Over the past few months there has been a constant Republican drumbeat on how incompetent and disastrous was the management of the ‘Biden Economy’. These claims and the lack of an effective rebuttal were among the main reasons why the Democrats lost the 2024 election. In my newsletter of January 24 I tried to show that the ‘disaster’ accusation was false, part of the disinformation environment that that has damaged democracy in America. Since this harmful narrative about the Biden economy continues relentlessly to this day I’m taking another look at it, how some of the key factors in the Trump 1.0 economy compared to those in the Biden economy, and what is signaled for Trump 2.0. This new look will also hopefully improve my first effort. It’s too long for a newsletter but I hope you can at least skim it!

A well-known study (Blinder and Watson 2016) showed that on reasonable assumptions there was a strong correlation between democratic Presidential terms and better economic performance over the seventy years since Eisenhower. A correlation is not proof, rather just circumstantial evidence, and it is difficult to prove that one party’s Presidency ‘caused’ better economic performance because of different time lags, complicated causal factors, and fate. But while there is no proof that the Democrats did better there has been to my knowledge no serious study showing a correlation between Republican Presidents and superior economic performance.

Trump and the Republicans have nevertheless made some of their most outrageous claims in criticizing the Biden economy. For example, just prior to the election he claimed that “over the past four years, Kamala and crooked Joe Biden have presided over an economic reign of terror, committing one financial atrocity after another.”

In March 2025 at a Joint Session of Congress he asserted: “we inherited from the last administration an economic catastrophe and an inflation nightmare.” On May 4 he stated on ‘Meet The Press:’ “I think the good parts are the Trump economy and the bad parts are the Biden economy because he’s done a terrible job.”

What Happened to US Output?

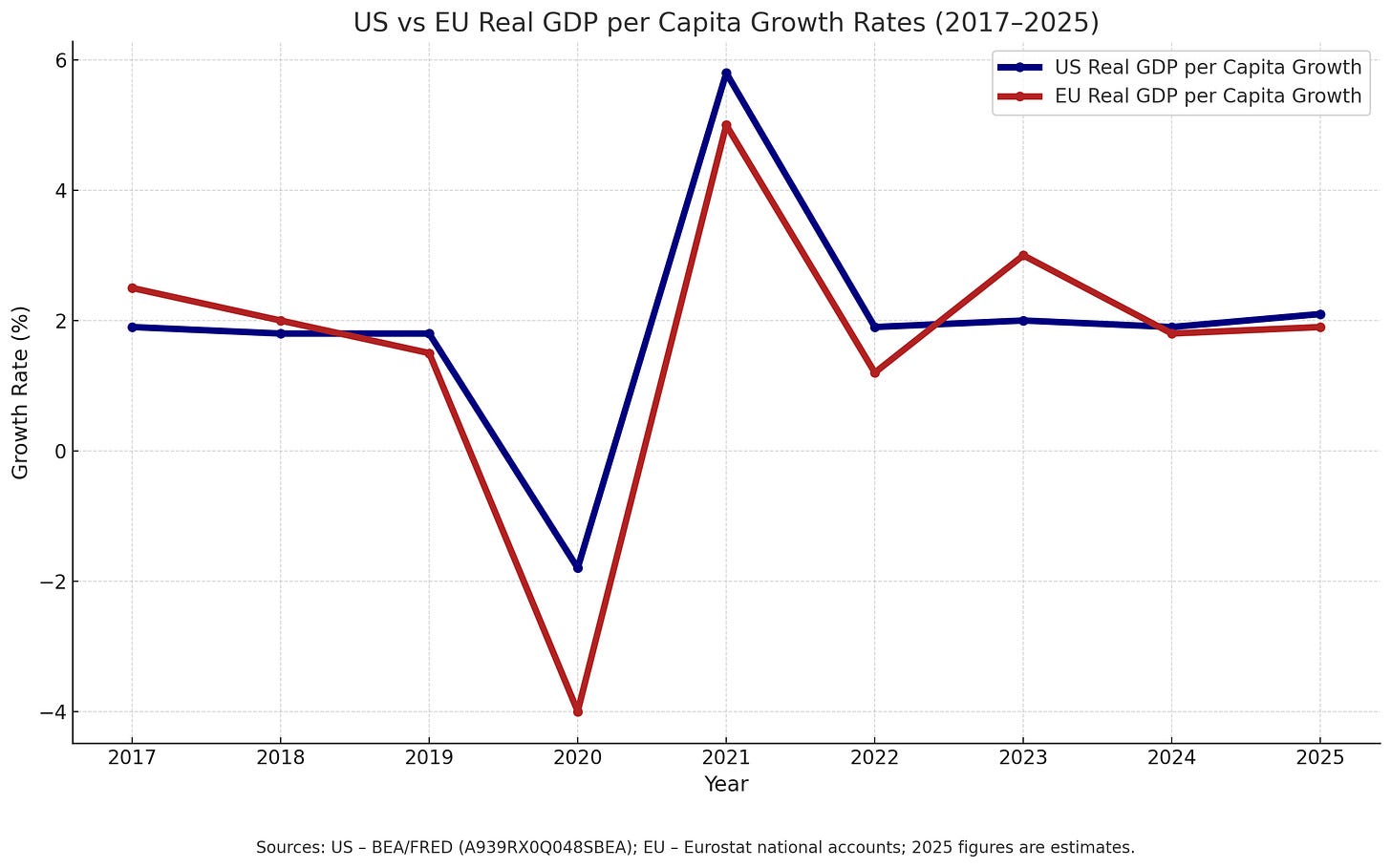

The following numbers are from usually reliable sources. As can be seen in the figure below there was in fact overall reasonably robust growth in output under Biden. Real GDP growth after the COVID period was on average higher than under Trump if we include the post-COVID bounce. If we don’t include it then growth according to these numbers was about the same or slightly higher than in Trump’s first three years (before COVID struck). In particular, a widely predicted recession in 2023 was avoided, probably due to good Fed monetary policy. Growth of GDP then continued without any let-up to the end of the Biden Presidency and into 2025.

The figure also compares what happened to output in the comparable advanced economies (ones with competitive markets) of the European Union. As can be seen from the figure the US and the EU growth patterns were overall similar over 2017 to 2024 although the COVID recession in the US was less severe.

Under Trump 1.0 the real GDP growth rate was level around 2% before crashing as a result of COVID. After a rapid recovery from the pandemic, reaching 6% growth for 2021 under Biden, it settled in 2023 at a level similar or marginally higher than the pre-COVID Trump years. This suggested that the US economy under Biden was performing quite well not only compared to past US performance under Trump but also in terms of international competition - and the claim of a ‘catastrophe’ was nonsense.

What Happened to Employment?

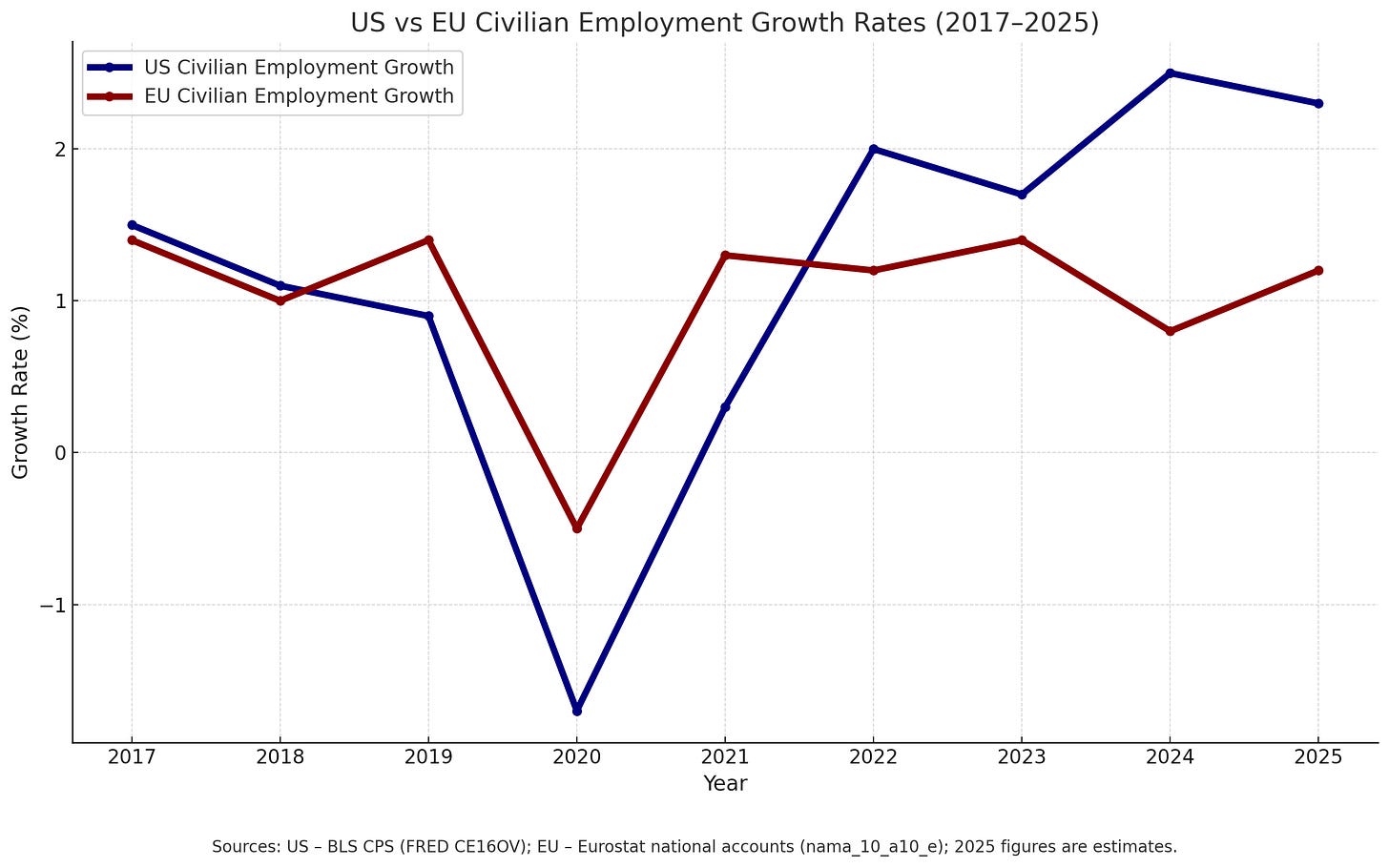

The figure below shows that growth in employment during the Trump period over 2017 to 2019, prior to the pandemic, averaged less than 2% per annum, significantly lower than the rate under Biden over 2021-24 which averaged 2 to 2.5% per annum. An estimated 8.9 million jobs were lost in the pandemic and 17 million overall created under Biden. The pandemic losses were fully compensated by the start of 2023, so almost half came after the end of the pandemic, in contrast to Republican claims that the increase was simply the result of recovery from the pandemic job losses, which was false

The figure shows the employment growth rate drop from the pandemic as being relatively severe compared to the EU but after 2020 the US growth rate surged ahead of the EU rate, recovering to above the pre-COVID level.

Trump stated in his 2024 convention speech that 100% of the new jobs post-pandemic were taken by illegal aliens. This was false. According to Forbes.com 60% of the jobs are estimated to have gone to the US-born and over 20% to Green Card and work visa holders. In addition, real wages started to rise (i.e. wage rises exceeded price rises) in 2023, helping to offset the problems for consumers caused by inflation.

Based on BLS figures (adjusted for a Jan 2025 change in method) the growth of employment all the way though the Biden Presidency continued into Trump’s presidency up to March 2025. In the last, 48th, month of Biden’s Presidency job growth remained well above expectations at 256,000, while labor force participation rate was stable or rising. After March, under Trump 2.0, the employment growth rate leveled off. Overall performance under Biden was better.

What Happened in the Stock Market?

The performance of the stock market is not the same thing as the performance of the economy but over time it does track it. The effectiveness of tracking depends on time lags and time horizons, expectations as opposed to actual conditions. However, for political purposes some Administrations have tended to emphasize it, especially when the results are good, and ignore them when they are bad. The Democrats have tended to ignore them either way!

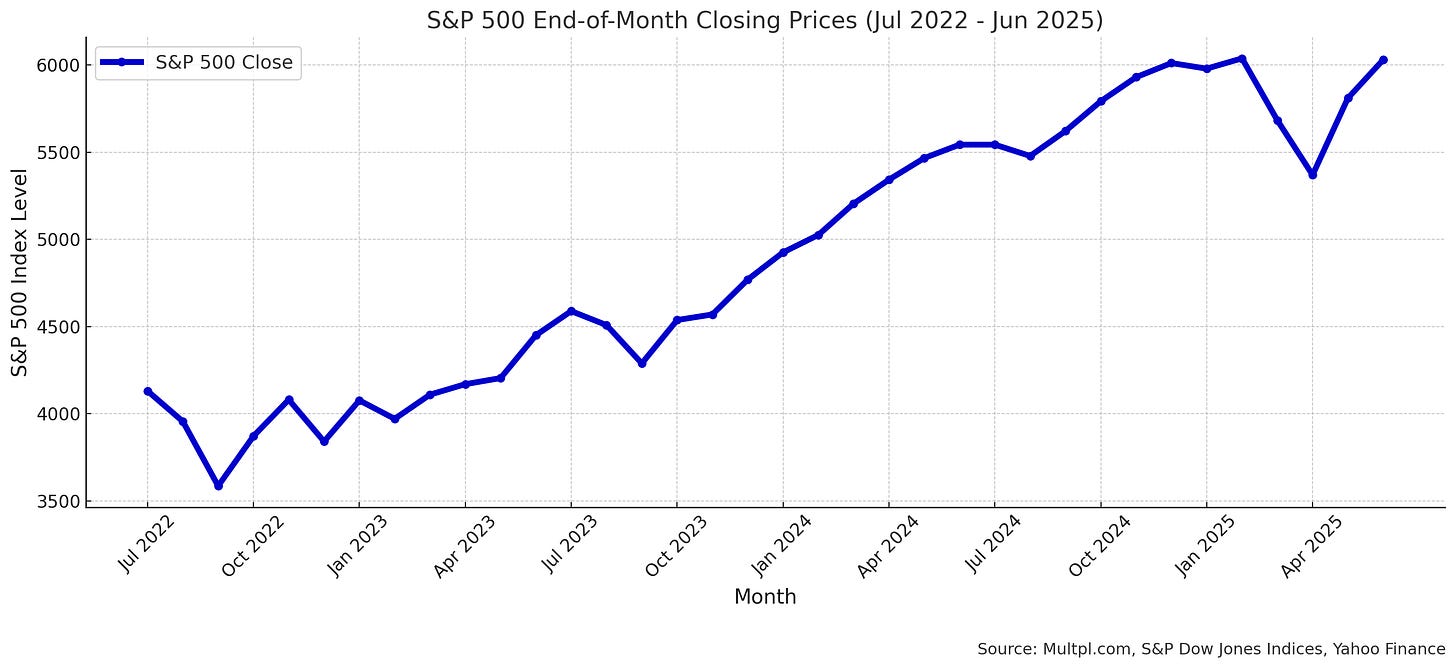

Over 2017 to 2025 Trump and Biden both faced major stock market ups and downs. During Trump 1.0 from 2017 to 2019 there were major overall gains in the main indices but late 2018 saw a large downward correction followed by a rebound in 2019 after Fed policy relaxed. In early 2020 the COVID shock created a record bear market followed later by a rebound fueled by large economic stimulus measures. During The Biden Presidency the upward movement continued with similar ups and downs. A huge market rally occurred as the economic stimulus to combat COVID continued, followed by a bear market in 2022. In late 2022 a long and relatively stable recovery began and the indices recovered to reach record highs by Biden’s last month in office (Jan 2025).

Trump 2.0 initially saw a continuation of market growth fueled by optimism about deregulation and tax cuts but then a drop because of uncertainty about trade barriers and budget deficits. Only by June 2025, half a year into Trump 2.0, did the S&P 500 and Nasdaq indices recover to the record level set under Biden.

The stock market boom of late 2022 to 2025 was particularly notable. As shown in the figure below the S&P 500 index rose almost without a break from October 2022 for over 2 years all the way through to the end of the Biden presidency, a rise of about 65%, then fell because of tariff uncertainty and finally rose again to June 2025. Alongside GDP and employment growth the record rise of the stock market over 2022 to 2024 would have been hailed from the rooftops as a victory by a Republican party in power but was set aside by Democrats apparently fearing that too much celebration of capital gains would alienate wage-earners whom they still saw as their voter base.

The take-way from this story is that there was no obvious major difference between the performance, growth and volatility of stocks experienced under Biden and Trump, taking account external factors such as COVID and recovery measures, and that there was no justification for asserting that the market behaved better overall under either President. Nevertheless, after the stock market dropped nearly 8% in the first quarter of his second Presidency Trump claimed on Truth Social that “This is Biden’s Stock Market, not Trump’s… it has NOTHING TO DO WITH TARIFFS, only that he left us with bad numbers.” This was false.

The Truth About Inflation.

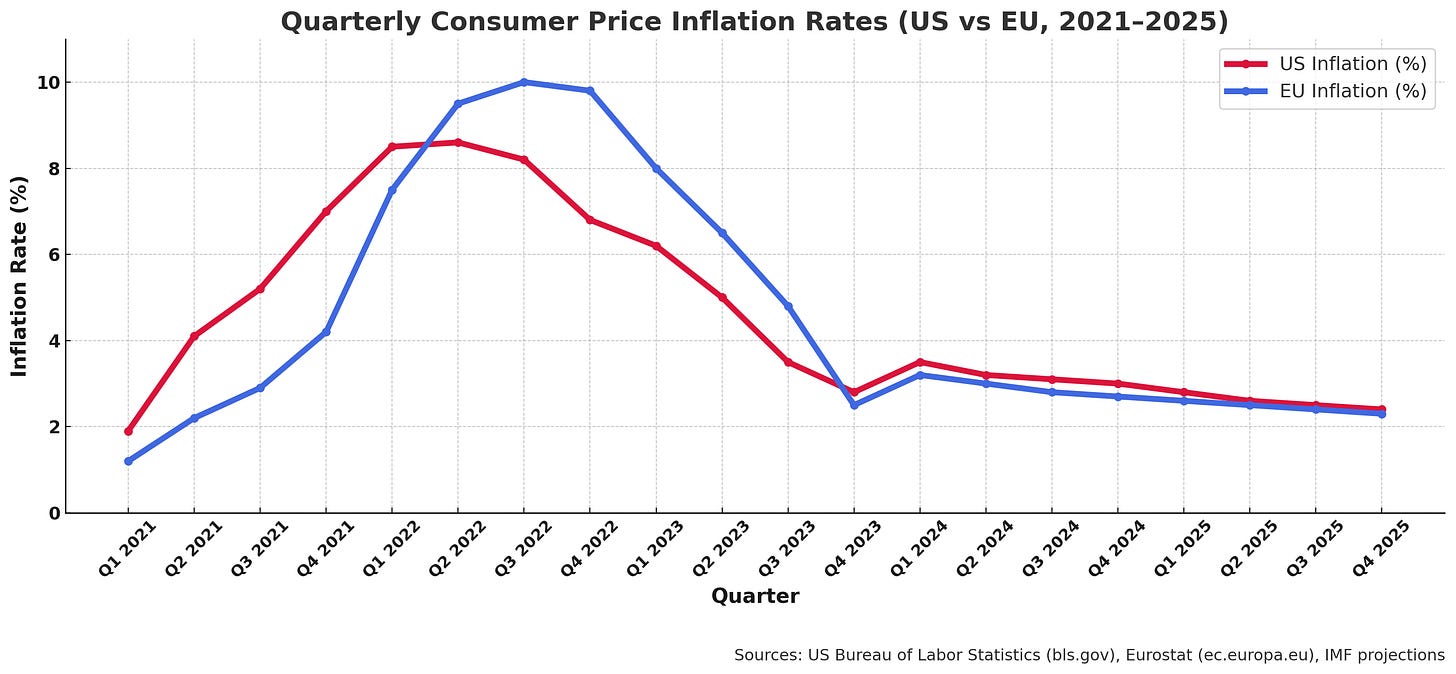

The US inflation over 2022-3 was according to the Trump Campaign “the worst inflation in American history”. This was not true since the worst in recent memory occurred at the end of the 1970s/early 80s, with the second oil shock. Many voters however accepted this claim and blamed the Democrats not only for the high prices but also for their supposed failure to bring them back down again, and this was one of the major reasons why they lost the election.

The chart below shows that over the three years 2017 to 2019 under Trump there was a low US inflation rate averaging just under 2% per annum. As the COVID pandemic started in early 2020 the rate surged, reaching an annual 8% and a peak of 9.1% in June 2022. It then dropped steadily back into the 2.5% range in 2024. Following this period the rate ticked up again to 3% and then dropped back to 2.5% in June, just above the Fed target rate. This could be seen as a triumph of inflation management, almost all on Biden’s watch.

For comparison, the US inflation rate had a similar pattern to the rate for the EU economies in its timing and trajectory over years around the COVID period. It did not rise to a rate as high as the EU but it had an almost identical inflation total over the four years, 20.8% against 20.4%. These numbers suggest that the US economy was behaving quite similarly to other market economies but recovering faster, probably because of more effective monetary policy.

For the population at large however the rate of price inflation was not the problem, but rather how it applied to the things that people wanted to purchase. The major prices rises in consumer goods were in foods such as margarine, juices and drinks, fats and oils, peanut butter, bread, sugar and eggs. All these rose 40% or more over the period, compared to the overall 20.4%. The largest item in the CPI index, about a quarter of the whole list, was rental costs which rose about 24.0%. The BLS also reported that some prices fell, especially clothing and chinaware, and electronic goods such as computers and smartphones. The price of cellphones adjusted for quality fell by over 50% from 2020 to 2024.

In the US the rapidly rising price of heavily purchased goods suggested that things were out of control. This provided a target for Republicans to heap blame on the US Government whereas in fact other countries such as in Europe had even higher individual goods price inflation. European food prices rose rapidly, e.g. olive oil, sugar, biscuits, and butter saw major price hikes, some of over 70%.

Inflation was no doubt largely caused by the disruptions of the global supply chain as a result of COVID which resulted in shipping delays, factory closures, and critical industrial input shortages such as chips, putting upward pressure on prices. Various studies have estimated that this explained the large majority of the inflation surge. Energy prices also jumped because of the Russia‑Ukraine war, worsening the situation, especially in Europe. As these disruptions eased in mid‑2022, inflation began to slow.

The main alternative explanation, favored largely by the Republicans, plus some independent economists (e.g. Larry Summers) was that inflation was the result of irresponsible economic stimulus measures after Biden took over. The largest economic stimulus program of all had in fact been the $2.2 trillion bipartisan CARES Act under Trump which cost over 10% of GDP. Biden added the $1.9 trillion American Rescue Plan Act, along with other smaller programs. Both these Acts were enormously expensive, but the Republicans argued that the second one was too late, not well targeted, inflationary, and that the extended unemployment benefits would encourage idle workers to stay at home. That is, it was a welfare giveaway. They also rejected the assurance that any price inflation would be transitory, claiming that a longer lasting, higher and more damaging inflation was the result of Biden’s economic mismanagement, promising on their side to stop it and even to bring prices down when they got back into power.

But in the end the Government it seems may have been right about it being transitory. In fact by late 2022, supply conditions had improved and energy shortage resulting from the Ukraine war had eased. US inflation started to fall earlier from its peak than many other advanced economies. At the same time wage increases since 2023 helped to relieve the pressure on families, along with the significant increase in jobs.

The price rises of both the US and the EU were similar in the scale, trajectory and pattern of individual price changes, and so could not reasonably be pinned on the policies of a particular Government. A study by Lazards (Peter Orzag) showed that the inflation was a world-wide effect of the pandemic, and that several more advanced economies such as the UK and Germany experienced the same or worse price inflation than the US despite not having large economic stimulus programs. In fact the US inflation was lower than that of nearly half of all countries despite the large relief spending. The fact that US inflation also fell more quickly from its peak of June 2022 compared to several other advanced economies also implied that Government intervention was not the key cause of inflation.

But Biden and his top advisers seemed rarely to go out in front of the cameras to effectively explain the issues. The New Yorker, commenting on the lack of popular understanding of the Government’s economic program, wrote just before the election, of a: “vast gulf between its scale ... and its political impact, which is essentially zero …”

Far from Trump’s claim about ‘inheriting an inflation nightmare,’ by the time of the 2024 election inflation was largely under control and the price rises had almost fallen back to the Fed target, leaving the Trump Administration in a good position provided that there were no mis-steps (such as aggressive threats of tariffs). But this achievement was never adequately publicized. Biden’s most effective addresses on the economy seem to have been delivered several weeks after the election was lost. A sustained and convincing rebuttal could probably have stemmed the tide of criticism and the damage to the Democrats’ electoral chances.

One of Trump’s main election promises was that he would not only bring down inflation but also reduce actual prices. This promise was impossible to fulfil because lowering general prices would need a serious recession or price controls, both equally undesirable. An imaginary alternative was that an enormous increase in the US oil and gas supply (‘drill, baby, drill!’) could reduce its price and lower costs in other parts of the economy, bringing general prices down. This idea however would need global oil demand to be under US control which it is not, as well as other complicating factors. The inflation rate has not fallen any further than in the last months of Biden’s term, nor did specific prices fall except due to outside factors like falling World oil prices or the end of bird flu, for eggs.

What Happened to Interest Rates?

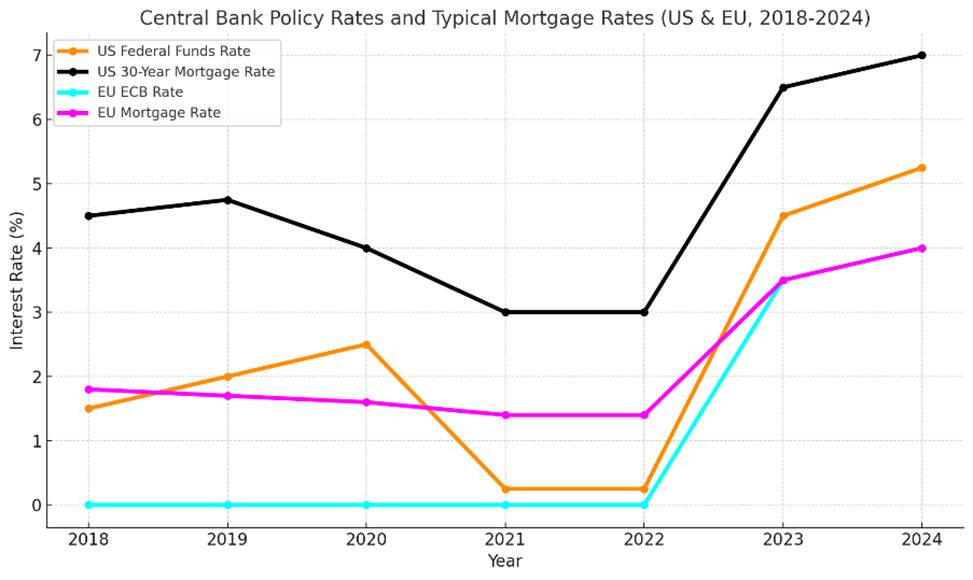

One of the main opposition charges against Biden was over the high interest rates which accompanied inflation, and Trump has compared the Fed’s cautious interest rate policies unfavorably to those of the European Central Bank (ECB). As shown in the figure above, prior to the COVID period the US Fed funds rate was higher than the ECB rate and US mortgage loan rates followed suit as they are linked to the Fed rate. The ECB basic rate was cut to zero after the 2008 financial crisis and remained there in order to stimulate recovery in relatively weak European economies, while the Fed rate was increased because of stronger growth and remained consistently higher. In March 2020 as COVID struck the Fed rate fell back to near zero to counter the recession and the ECB held down its already very low rate, even to negative levels. From 2022 as the pandemic faded the Fed raised rates aggressively, ahead of the ECB, but the gap between the two rates was just one percent, not significant in terms of previous experience.

The housing loan (mortgage) rate was the one that has caused the most grief for individuals in the US and further polarized the voting population. From the figure it can be seen that the gap between the EU and US mortgage rate rose greatly from 1.5% in 2022 to 3.5% in 2024. There are various factors, including stronger economic growth and the way the rates are set, in why general US rates have been higher than ECB rates for a long time, and these have increased the gap, but Mortgage rates in the US have still been kept higher than many have advised. In December 2023 Powell, the Fed chair, said: “We are acutely aware that higher rates weigh heavily on the housing market. But easing prematurely would risk a repeat of the stop-go policies that failed to bring inflation under control in the past.” The San Francisco Fed President in January 2024 said: “It is painful to see first-time buyers priced out of the market, but we must remember that price stability benefits everyone in the long term.”

Such independence of interest rate policy is protected under the 1913 Federal Reserve Act but this is currently under increasing pressure. “I think he’s a very stupid person, actually” said Trump at a NATO meeting on June 25 about his own Fed Chair appointee, Jerome Powell. There is no doubt that the housing situation is very tough and that this is not assisted by a high mortgage rate. But the Fed’s stated need to guard against renewed inflation by keeping the rate up has been strengthened over the last few months because of the inflation uncertainty created by continued tariff threats. So, this particular issue is another that cannot just be laid at Biden’s door.

Other Things - What about Manufacturing and Energy?

Finally, both Trump and Biden have advocated versions of the contentious aim of ‘re-industrializing’ the US, with Biden opting for the more progressive model and Trump looking to bring back the industries of the earlier twentieth Century. Trump is trying to help the coal industry by boosting production and repealing environmental regulations and has prioritized steel and aluminium through tariff protection. However, many sources have stated that boosting employment in these specific products would be at the cost of losing general manufacturing jobs due to higher the resulting input costs. Biden has prioritized semiconductors under the 2022 CHIPS & Science Act. He also prioritized EV batteries and clean-energy manufacturing in solar, battery, heat pump, and clean-tech, in none of which Trump has great interest. Which of these two options is more likely to provide more economic benefits is another story, but certainly the Biden option does not appear to be the loser at this point.

Regarding energy, Trump stated at a campaign rally in 2024 that he would “declare a national emergency to allow us to dramatically increase energy production, generation, and supply, which Comrade Kamala has destroyed.” In reality American oil and gas production under Biden rose to record levels and the US is now the World’s largest oil producer, remarkably larger even than Russia and Saudi Arabia, while at the same time renewable energy also increased significantly under Biden’s watch.

What Are We To Conclude From All This?

From this too-brief but too-long ‘newsletter’ I think that the truth about Biden’s economy is nevertheless clear. Its performance was not inferior to that of Trump 1.0 and was very likely superior, rejecting the baseless claims against it. But based on the opening discussion of this letter there is little point in trying to prove it, rather simply to proactively support the common sense narrative that has been lost in the fog of US disinformation. The economic data that is available for the first half year of Trump 2.0 does not show any indication of ‘the start of a golden age’ in terms of the things I have discussed, i.e. GDP, employment, inflation, interest rates, stock prices, and production.

The US is embarking on an ultra-high-risk strategy on the economy as well as the other critical areas that I have not touched upon. The objectives and the road to achieving them are obscure even to many of its supposed supporters. When in fantasy land we have to focus clearly on reality and make sure that it re-emerges from the disinformation fog.

Finally, my standard disclaimer. The argument in this letter has depended on a lot of data some of which has been subject to methodology change, or which I may have misinterpreted or otherwise abused in the short time available to put it all together. Any errors are mine, but I am sure that the basic story is correct.

I know this is too long but I hope that you have managed to get to the end and find something of value - and please comment!

Best wishes to all

David